A Guide To Financial Success

Bruce Bochy Net Worth: Determining an Individual's Financial Standing

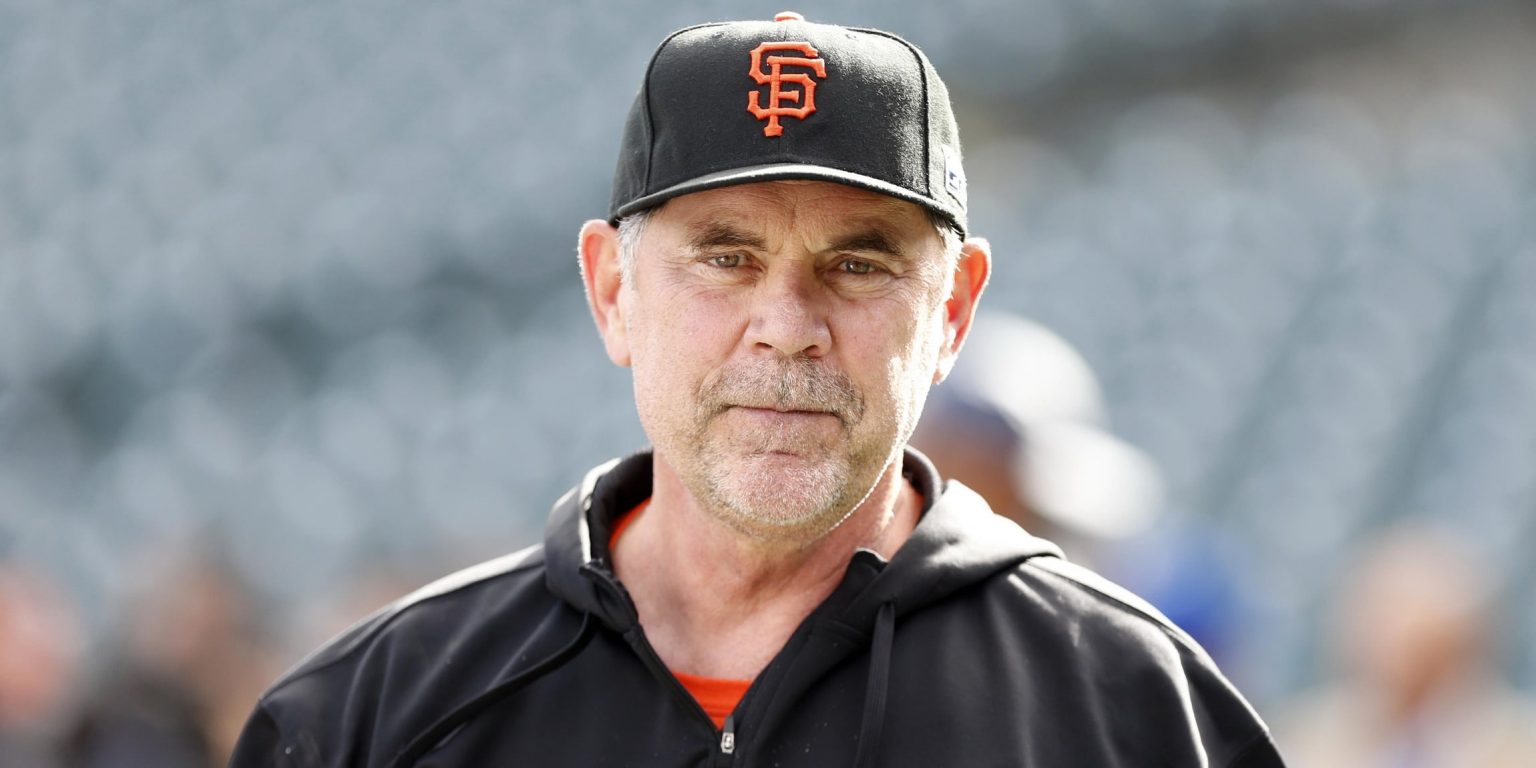

"Bruce Bochy Net Worth" is a phrase used to describe the total value of an individual's assets, including property, investments, and cash. It serves as a financial snapshot, offering insights into a person's wealth and financial success. Determining Bruce Bochy's net worth, for instance, allows individuals to assess the legendary baseball manager's financial accomplishments and compare his wealth to others in his field.

Understanding an individual's net worth holds significant importance. It can provide valuable information for financial planning, investment decisions, and tax optimization. Historically, tracking net worth has been a crucial practice for individuals and businesses alike, allowing them to monitor financial progress and make informed decisions.

Bruce Bochy Net Worth

Grasping the multifaceted elements that shape "Bruce Bochy Net Worth" is essential for comprehending the financial standing and success of the renowned baseball manager.

- Assets

- Investments

- Cash

- Income

- Expenses

- Liabilities

- Financial Goals

- Tax Implications

Understanding these aspects provides a comprehensive view of Bruce Bochy's financial situation. His assets, investments, and cash holdings represent the foundation of his wealth. Income and expenses shed light on his cash flow and spending patterns, while liabilities indicate any outstanding debts or obligations. Financial goals reveal his aspirations and plans for the future, and tax implications highlight the impact of taxes on his overall net worth.

Assets

In the financial equation of "Bruce Bochy Net Worth," assets play a pivotal role. Assets are anything of value that Bruce Bochy owns, and they contribute directly to his overall wealth. The significance of assets lies in their ability to generate income, appreciate in value, or provide utility. Bruce Bochy's assets likely include a diverse range of investments, such as real estate, stocks, bonds, and collectibles. These assets represent his accumulated wealth and serve as a foundation for his financial security.

The relationship between assets and Bruce Bochy's net worth is straightforward: the greater the value of his assets, the higher his net worth. This relationship highlights the importance of asset management and investment strategies in building and maintaining wealth. By acquiring and managing valuable assets, Bruce Bochy can increase his net worth and secure his financial future.

Understanding the connection between assets and net worth is crucial for anyone seeking financial success. It emphasizes the importance of investing in assets that align with one's financial goals and risk tolerance. By building a diversified portfolio of assets, individuals can potentially generate income, grow their wealth, and achieve long-term financial stability.

Investments

Investments are a fundamental pillar of Bruce Bochy's net worth, representing a strategic allocation of his financial resources with the primary goal of generating income and capital appreciation. Bruce Bochy's investment portfolio likely encompasses a diverse mix of asset classes, each with its own unique characteristics and return potential.

- Stocks: Stocks represent ownership in publicly traded companies, offering the potential for capital appreciation and dividend income. Bruce Bochy may hold stocks in various sectors and industries, aligning with his risk tolerance and investment objectives.

- Bonds: Bonds are fixed-income securities that provide regular interest payments and return the principal amount at maturity. Bonds offer a lower risk-return profile compared to stocks, potentially serving as a stabilizing force in Bruce Bochy's portfolio.

- Real Estate: Real estate investments involve owning and managing properties, including residential, commercial, and land. Bruce Bochy may invest in real estate for rental income, capital appreciation, or both, diversifying his portfolio and potentially generating passive income.

- Alternative Investments: Alternative investments encompass a broad range of assets that fall outside traditional categories, such as hedge funds, private equity, and commodities. These investments often have higher risk-return profiles and may be employed by Bruce Bochy to enhance diversification and seek potential alpha.

The composition and performance of Bruce Bochy's investment portfolio directly impact his net worth. Prudent investment decisions, diversification, and a long-term perspective are crucial for maximizing returns and preserving capital. By actively managing his investments, Bruce Bochy can potentially grow his wealth and achieve his financial goals.

Cash

Cash, a crucial component of Bruce Bochy's net worth, represents the most liquid and accessible form of wealth. Unlike assets or investments, cash is readily available for immediate use, offering flexibility and convenience.

- Cash on Hand: Physical currency and coins held by Bruce Bochy, easily accessible for everyday transactions and emergencies.

- Checking Accounts: Liquid funds deposited in checking accounts, providing easy access through checks, debit cards, and online banking.

- Savings Accounts: Liquid funds earning interest while maintaining accessibility, offering a balance between liquidity and returns.

- Money Market Accounts: Interest-bearing accounts that offer check-writing privileges and may have higher interest rates than savings accounts.

The amount of cash Bruce Bochy holds influences his net worth and overall financial flexibility. Ample cash reserves provide a buffer against unexpected expenses, allow for opportunistic investments, and facilitate financial emergencies. However, excessive cash holdings may indicate missed opportunities for investment growth or inefficient use of resources.

Income

Income, a vital cog in the machinery of "Bruce Bochy Net Worth," represents the inflow of funds that contribute directly to his overall wealth. Bruce Bochy's income streams, whether from his managerial contracts, endorsements, or investments, play a pivotal role in shaping his financial standing.

The connection between income and net worth is straightforward: higher income typically leads to a higher net worth. Consistent and substantial income allows Bruce Bochy to accumulate assets, invest in growth opportunities, and increase his overall wealth. Conversely, a decline in income can adversely affect his net worth, potentially impacting his ability to maintain his lifestyle or achieve financial goals.

For instance, during his managerial tenure with the San Francisco Giants, Bruce Bochy's annual salary and bonuses significantly contributed to his net worth. His success in leading the Giants to three World Series championships undoubtedly enhanced his earning potential and financial stature.

Understanding the relationship between income and net worth is crucial for anyone seeking financial success. It emphasizes the importance of securing and maintaining a steady income stream to build wealth over time. By exploring income-generating opportunities, managing expenses wisely, and making informed investment decisions, individuals can potentially increase their net worth and secure their financial futures.

Expenses

Expenses, a fundamental aspect of "Bruce Bochy Net Worth," represent the outflow of funds that reduce an individual's overall wealth. Understanding the various components of Bruce Bochy's expenses is crucial for assessing his financial standing and identifying potential areas for optimization.

- Living Expenses: These expenses cover basic necessities such as housing, utilities, groceries, and transportation, which are essential for maintaining Bruce Bochy's lifestyle and well-being.

- Taxes: Taxes, including income tax, property tax, and sales tax, represent a significant portion of Bruce Bochy's expenses. Tax payments contribute to the functioning of public services and infrastructure and can impact his disposable income.

- Investments: While investments generally contribute to net worth growth, they can also incur expenses such as management fees, transaction costs, and potential losses. Bruce Bochy's investment strategy and risk tolerance influence these expenses.

- Charitable Contributions: Bruce Bochy's philanthropic endeavors involve expenses related to charitable donations and support for various causes. These contributions reflect his values and commitment to giving back to the community.

Managing expenses effectively is essential for Bruce Bochy to maintain his net worth and achieve his financial goals. By optimizing expenses without compromising his lifestyle, he can allocate more resources towards saving, investing, and building long-term wealth.

Liabilities

Liabilities represent a crucial aspect of "Bruce Bochy Net Worth," encompassing any financial obligations or debts that reduce his overall financial standing. Understanding the nature and extent of Bruce Bochy's liabilities is essential for assessing his financial health and making informed decisions.

- Outstanding Loans: Bruce Bochy may have outstanding loans, such as mortgages, car loans, or personal loans. These loans represent liabilities as they obligate him to make regular payments and incur interest charges.

- Taxes Payable: Liabilities can also include unpaid taxes, such as income tax, property tax, or sales tax. Failure to fulfill these obligations can result in penalties and legal consequences.

- Contractual Obligations: Bruce Bochy's managerial contracts or endorsement deals may involve contractual obligations that create liabilities. These obligations could include performance bonuses, termination fees, or payments to agents or representatives.

- Legal Liabilities: In certain circumstances, Bruce Bochy may face legal liabilities, such as lawsuits or judgments. These liabilities can arise from various situations, including accidents, disputes, or claims against him.

The presence and management of liabilities can significantly impact Bruce Bochy's net worth. High levels of liabilities can reduce his financial flexibility, limit his ability to borrow or invest, and potentially damage his creditworthiness. Conversely, responsible management of liabilities, such as timely debt repayment and prudent financial planning, can contribute to maintaining a healthy net worth and long-term financial well-being.

Financial Goals

Financial goals serve as the guiding force behind Bruce Bochy's net worth, providing direction and purpose to his financial decisions. These goals represent his aspirations and objectives, influencing how he manages his income, expenses, investments, and overall financial strategy.

The connection between financial goals and Bruce Bochy's net worth is bidirectional. Well-defined financial goals drive him to accumulate wealth, make sound investments, and optimize his financial resources. Conversely, his net worth provides the foundation for achieving those goals, enabling him to pursue financial independence, fund major purchases, and secure his future.

Examples of Bruce Bochy's financial goals may include retiring comfortably, funding his children's education, or establishing a charitable foundation. By setting specific, measurable, achievable, relevant, and time-bound goals, Bruce Bochy creates a roadmap for his financial journey and increases the likelihood of achieving his desired outcomes.

Understanding the integral connection between financial goals and net worth is crucial for effective financial planning and management. It empowers individuals to align their financial decisions with their long-term aspirations, make informed choices about resource allocation, and ultimately build a strong financial foundation that supports their goals and dreams.

Tax Implications

Tax implications play a significant role in shaping Bruce Bochy's net worth, as they directly impact the amount of income and assets he retains after fulfilling his tax obligations. Understanding the cause-and-effect relationship between tax implications and Bruce Bochy's net worth is essential for effective financial planning and wealth management.

The tax implications Bruce Bochy faces primarily stem from various sources of income, including his managerial salary, endorsement deals, and investment returns. He is subject to federal and state income taxes, which are levied on his taxable income, and the rates vary depending on his income level and deductions. Additionally, Bruce Bochy may be liable for property taxes on his real estate holdings and capital gains taxes when he sells investments.

Real-life examples within Bruce Bochy's net worth that illustrate the impact of tax implications include the following: a portion of his managerial salary is withheld for taxes before he receives his paycheck; when he sells stocks or bonds, he incurs capital gains taxes on the profits; and he must pay property taxes on his residence and any other real estate investments he owns.

The practical significance of understanding the connection between tax implications and Bruce Bochy's net worth lies in its implications for financial planning and wealth management. By considering the tax consequences of his financial decisions, Bruce Bochy can optimize his tax strategy, minimize his tax liability, and maximize his net worth. This involves exploring tax-saving strategies such as maximizing deductions and utilizing tax-advantaged investments, which can help him retain a greater portion of his income and assets.

Frequently Asked Questions about Bruce Bochy Net Worth

This FAQ section aims to provide clear and concise answers to commonly asked questions regarding Bruce Bochy's net worth, shedding light on various aspects of his financial standing.

Question 1: What is Bruce Bochy's estimated net worth?Bruce Bochy's net worth is estimated to be around $50 million, accumulated through his successful career as a baseball manager and various endorsements.

Question 2: What are the primary sources of Bruce Bochy's income?Bruce Bochy's income primarily comes from his managerial salary, endorsement deals with companies like Under Armour and Topps, and investment returns.

Question 3: How has Bruce Bochy's net worth changed over time?Bruce Bochy's net worth has steadily increased over the years, particularly during his tenure as manager of the San Francisco Giants, where he led the team to three World Series championships.

Question 4: What are some of Bruce Bochy's notable financial accomplishments?One of Bruce Bochy's notable financial accomplishments is his savvy investment in real estate, which has contributed significantly to his overall net worth.

Question 5: How does Bruce Bochy manage his wealth?Bruce Bochy is known for his prudent financial management, prioritizing long-term investments and seeking professional advice to optimize his financial decisions.

Question 6: What is the significance of understanding Bruce Bochy's net worth?Understanding Bruce Bochy's net worth provides insights into the financial success of a legendary baseball manager, showcasing the potential for wealth accumulation through a combination of career earnings, investments, and endorsements.

In summary, Bruce Bochy's net worth is a testament to his financial acumen and successful career in baseball. It underscores the importance of prudent financial management and strategic investments in building and preserving wealth.

Moving forward, we will delve deeper into Bruce Bochy's investment strategies, exploring the specific tactics and philosophies that have contributed to his financial success.

Tips for Building Wealth Like Bruce Bochy

The following tips, inspired by Bruce Bochy's financial journey, provide actionable insights to help you build wealth and achieve financial success:

Tip 1: Set Clear Financial Goals: Define your financial aspirations, whether it's retiring early, funding your children's education, or building a passive income stream. Having goals will guide your financial decisions and keep you motivated.

Tip 2: Invest Early and Consistently: Start investing as early as possible, even with small amounts. Utilize the power of compound interest to grow your wealth over time. Consider a diversified portfolio of stocks, bonds, and real estate to manage risk.

Tip 3: Live Below Your Means: Practice mindful spending and avoid unnecessary expenses. Create a budget that allocates funds to essential needs, savings, and investments. Living below your means allows you to accumulate wealth faster.

Tip 4: Seek Professional Advice: Consult with a financial advisor or tax professional to optimize your financial strategy. They can provide personalized guidance based on your unique circumstances and help you make informed decisions.

Tip 5: Stay Informed: Continuously educate yourself about personal finance, investing, and tax laws. Knowledge empowers you to make sound financial choices and adapt to changing economic conditions.

Tip 6: Be Patient and Disciplined: Building wealth is a marathon, not a sprint. Stay disciplined with your savings and investment plan, even during market fluctuations. Patience and perseverance are key to achieving long-term financial success.

Tip 7: Explore Alternative Income Streams: Consider generating additional income through side hustles, rental properties, or royalties. Diversifying your income sources can enhance your financial resilience and accelerate wealth accumulation.

Tip 8: Give Back: While building wealth is important, remember the power of philanthropy. Make charitable contributions to support causes you care about. Giving back not only benefits others but can also bring personal fulfillment.

Implementing these tips can help you build wealth, secure your financial future, and make a positive impact on your community. Remember, financial success is a journey that requires discipline, perseverance, and a commitment to continuous learning.

As we conclude, it's essential to recognize that wealth is not solely about accumulating assets. True financial well-being encompasses financial security, personal fulfillment, and the ability to make a meaningful contribution to society. By embracing these principles, you can emulate Bruce Bochy's financial acumen and achieve your own version of financial success.

Conclusion

Our exploration of "Bruce Bochy Net Worth" has illuminated several key ideas. Firstly, Bruce Bochy's financial success stems from a combination of his managerial salary, endorsement deals, and astute investments. Secondly, his financial journey underscores the importance of setting clear financial goals, investing early and consistently, and seeking professional advice when necessary. By understanding the multifaceted nature of Bruce Bochy's net worth, we gain valuable insights into the financial strategies that have contributed to his financial well-being.

The lessons gleaned from Bruce Bochy's financial acumen can serve as a guide for our own financial journeys. By embracing the principles of financial planning, disciplined saving, and strategic investing, we can work towards building our own financial legacies. Remember, wealth is not merely about accumulating assets; it encompasses financial security, personal fulfillment, and the ability to make a positive impact on our communities.

How To Build Wealth Like Gabby Windey: Achieving Financial Success In 2024

How To Build A Net Worth Like Gaby Hoffmann: A Comprehensive Guide

How To Uncover Margaret Qualley's Net Worth: A Comprehensive Guide

ncG1vNJzZmirpaWys8DEmqRrZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmabqqWYsm6uzpyfsmWemsFuw86rq6FmmKm6rQ%3D%3D